Unveiling The Meaning Of "Pty Ltd": A Comprehensive Guide

Pty Ltd (pronounced "pty limited") is an abbreviation that adorns the names of many Australian businesses. As a legal suffix, Pty Ltd denotes a company limited by shares, which means that the liability of its owners is restricted to the value of their investment.

The adoption of Pty Ltd in Australia stems from a 1992 legislative reform that simplified business registration and operations. It gained popularity due to its flexibility, cost-effectiveness, and legal protections it offered.

Delving further into Pty Ltd companies, this article will explore their composition, advantages, tax implications, and the processes involved in their formation and dissolution.

What is Pty Ltd

Understanding the various facets of "Pty Ltd" is crucial for comprehending the legal and operational aspects of Australian businesses.

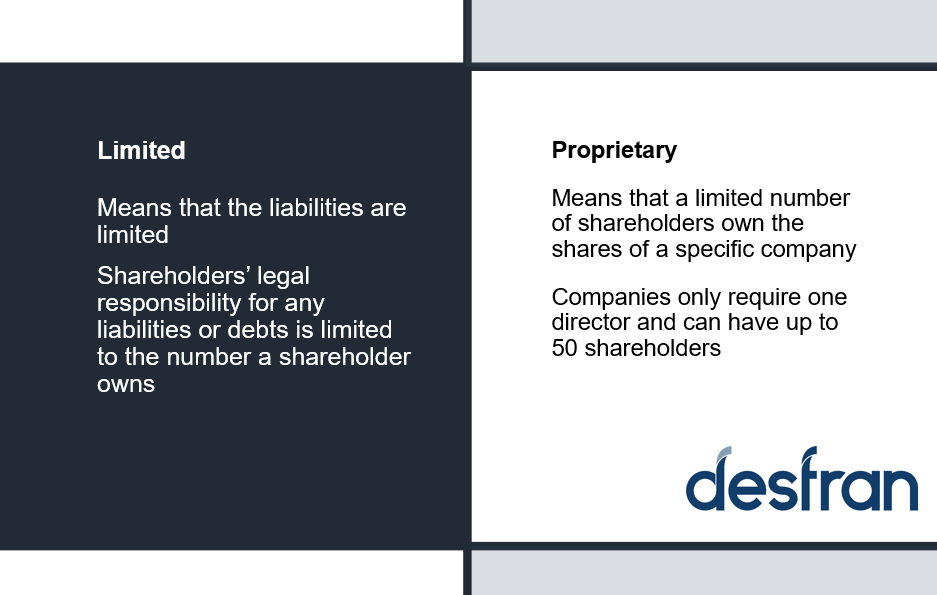

- Acronym: Pty Ltd is an acronym that stands for "proprietary limited," indicating a specific type of company structure.

- Legal Entity: A Pty Ltd company is a separate legal entity from its owners, providing liability protection.

- Shareholders: Pty Ltd companies have shareholders who own shares in the company and have limited liability.

- Directors: Pty Ltd companies are managed by directors who are responsible for the company's operations.

- Taxation: Pty Ltd companies are subject to corporate tax rates and may be eligible for certain tax concessions.

- Compliance: Pty Ltd companies must comply with various legal and regulatory requirements, including annual reporting and financial audits.

- Dissolution: Pty Ltd companies can be dissolved voluntarily or involuntarily through a formal process.

- Advantages: Pty Ltd companies offer several advantages, including liability protection, tax benefits, and flexibility in operations.

These key aspects provide a comprehensive overview of "Pty Ltd" companies, highlighting their legal, financial, and operational characteristics. Understanding these aspects is essential for individuals considering establishing or working with Pty Ltd companies in Australia.

Acronym

The connection between the acronym "Pty Ltd" and the phrase "what is pty ltd means" lies in the fact that understanding the acronym's meaning is crucial for comprehending the concept of Pty Ltd companies. The acronym "Pty Ltd" is an abbreviation of the term "proprietary limited," which refers to a specific type of company structure in Australia. This structure implies that the liability of the company's owners is limited to the value of their investment, providing them with protection against personal liability for the company's debts and obligations.

In real-life scenarios, the acronym "Pty Ltd" is commonly used in the names of Australian businesses to indicate their legal structure as a proprietary limited company. For instance, a company named "ABC Pty Ltd" would be a proprietary limited company, distinct from its owners, and offering liability protection to its shareholders.

Understanding the connection between the acronym "Pty Ltd" and its meaning is essential for individuals interacting with Australian businesses. It helps in recognizing the legal nature of the company, the level of liability its owners have, and the implications for business transactions and legal responsibilities. This understanding is particularly important in contexts such as entering into contracts, conducting due diligence, or seeking legal remedies, as it provides insights into the company's structure and the rights and obligations of its owners.

Legal Entity

Understanding the concept of "Legal Entity: A Pty Ltd company is a separate legal entity from its owners, providing liability protection." is fundamental to comprehending "what is pty ltd means." This aspect highlights the distinct legal status of Pty Ltd companies, offering valuable protection to their owners.

- Separate Legal Entity

A Pty Ltd company has a legal existence independent of its owners. It can enter into contracts, own property, and incur debts in its own name.

- Liability Protection

Shareholders of a Pty Ltd company are generally not personally liable for the company's debts or obligations. Their liability is limited to the amount invested in the company.

- Business Continuity

The legal separation between a Pty Ltd company and its owners ensures business continuity. The company's existence and operations are not affected by changes in ownership or the personal circumstances of its owners.

- Tax Implications

Pty Ltd companies are taxed as separate legal entities, distinct from their owners. This has implications for tax planning and compliance.

In summary, the concept of "Legal Entity: A Pty Ltd company is a separate legal entity from its owners, providing liability protection" is a cornerstone of Pty Ltd companies in Australia. It provides a clear distinction between the company and its owners, safeguards their personal assets, and facilitates business continuity and tax planning.

Shareholders

Understanding the concept of "Shareholders: Pty Ltd companies have shareholders who own shares in the company and have limited liability." is essential to comprehending "what is pty ltd means." This aspect highlights the ownership structure and liability protection afforded to Pty Ltd companies in Australia.

Pty Ltd companies are owned by shareholders who hold shares in the company. These shares represent a portion of the company's ownership and entitle shareholders to a share of the company's profits and assets. Importantly, the liability of shareholders is limited to the value of their investment in the company.

This limited liability is a key feature of Pty Ltd companies and provides significant protection to shareholders. It means that shareholders are not personally responsible for the debts or obligations of the company beyond the amount they have invested. This encourages investment and risk-taking, as shareholders can participate in the company's success without exposing their personal assets to excessive risk.

In summary, the concept of "Shareholders: Pty Ltd companies have shareholders who own shares in the company and have limited liability." is a defining characteristic of Pty Ltd companies in Australia. It establishes the ownership structure, limits the liability of shareholders, and facilitates investment and business growth.

Directors

Understanding the concept of "Directors: Pty Ltd companies are managed by directors who are responsible for the company's operations." is crucial to comprehending "what is pty ltd means." This aspect highlights the management structure and responsibilities within Pty Ltd companies in Australia.

Pty Ltd companies are managed by a board of directors who are elected by the shareholders. The directors are responsible for the overall management and operation of the company. They make decisions on behalf of the company, set strategic direction, and ensure compliance with legal and regulatory requirements.

The role of directors in Pty Ltd companies is critical because they are accountable for the company's performance and decision-making. They must act in the best interests of the company and its shareholders, and they can be held personally liable for any breaches of their duties.

In summary, the concept of "Directors: Pty Ltd companies are managed by directors who are responsible for the company's operations." is a fundamental component of "what is pty ltd means." It establishes the management structure, defines the roles and responsibilities of directors, and emphasizes their accountability for the company's performance and compliance.

Taxation

The concept of "Taxation: Pty Ltd companies are subject to corporate tax rates and may be eligible for certain tax concessions." is an integral component of "what is pty ltd means." It highlights the tax obligations and potential benefits associated with Pty Ltd companies in Australia.

Pty Ltd companies, like other corporations in Australia, are subject to corporate tax rates on their taxable income. This means that they must pay a percentage of their profits to the Australian Taxation Office (ATO) as tax. However, Pty Ltd companies may also be eligible for certain tax concessions and deductions, which can reduce their overall tax liability.

For example, Pty Ltd companies may be eligible for the small business tax offset, which can reduce their tax payable by up to $1,000 per year. Additionally, Pty Ltd companies may be able to claim deductions for expenses incurred in the course of running their business, such as advertising, marketing, and depreciation on assets.

Understanding the taxation implications of Pty Ltd companies is crucial for business owners and investors. By carefully considering the tax rates and concessions available, business owners can make informed decisions about the structure and operation of their Pty Ltd companies to minimize their tax liability and maximize their profits.

Compliance

Understanding the aspect of "Compliance: Pty Ltd companies must comply with various legal and regulatory requirements, including annual reporting and financial audits." is crucial to comprehending "what is pty ltd means." Compliance forms the bedrock of responsible and transparent business practices, ensuring that Pty Ltd companies operate within the bounds of the law and fulfill their obligations.

- Statutory Reporting

Pty Ltd companies are required to submit annual reports to the Australian Securities and Investments Commission (ASIC), disclosing their financial performance, directors' details, and other key information. This promotes transparency and accountability.

- Financial Audits

Larger Pty Ltd companies must undergo financial audits conducted by independent auditors. Audits provide assurance to shareholders and other stakeholders about the accuracy and reliability of the company's financial statements.

- Tax Compliance

Pty Ltd companies must comply with Australian tax laws, including filing tax returns and paying taxes on time. Compliance ensures that companies fulfill their tax obligations and contribute to the nation's revenue.

- Industry Regulations

Depending on their industry, Pty Ltd companies may need to comply with specific regulations and standards. For example, companies in the financial services sector must adhere to regulations set by the Australian Prudential Regulation Authority (APRA).

Compliance with legal and regulatory requirements is not only a legal obligation but also a mark of good corporate governance. It fosters trust among stakeholders, reduces risks, and ensures that Pty Ltd companies operate ethically and responsibly within the Australian business landscape.

Dissolution

The aspect of "Dissolution: Pty Ltd companies can be dissolved voluntarily or involuntarily through a formal process." holds significance in understanding "what is pty ltd means." It refers to the legal procedures involved in winding up and terminating a Pty Ltd company's existence.

- Voluntary Dissolution

A Pty Ltd company can voluntarily dissolve if the shareholders and directors agree to do so. This process involves passing a resolution to wind up the company and appointing a liquidator to oversee the process.

- Involuntary Dissolution

A Pty Ltd company can be involuntarily dissolved by a court order. This may occur due to insolvency, failure to comply with legal requirements, or other reasons as determined by the court.

- Liquidation Process

During dissolution, the company's assets are liquidated, and the proceeds are distributed to creditors and shareholders. The liquidator ensures that all legal and financial obligations are met before the company is formally dissolved.

Understanding the process of dissolution is crucial as it provides clarity on the legal implications of winding up a Pty Ltd company. It involves careful planning, compliance with legal requirements, and the distribution of assets and liabilities in an orderly manner.

Advantages

Understanding the connection between "Advantages: Pty Ltd companies offer several advantages, including liability protection, tax benefits, and flexibility in operations." and "what is pty ltd means" is crucial for comprehending the overall concept of Pty Ltd companies in Australia.

The advantages offered by Pty Ltd companies are intrinsic to their definition and purpose. Liability protection, tax benefits, and flexibility in operations are key reasons why businesses choose to operate as Pty Ltd companies. The legal structure of a Pty Ltd company provides limited liability to its shareholders, safeguarding their personal assets from business debts and obligations. This advantage encourages entrepreneurship and risk-taking, promoting economic growth.

Furthermore, Pty Ltd companies enjoy certain tax benefits. They can take advantage of tax deductions and concessions designed to support small businesses. The ability to minimize tax liability through smart tax planning allows Pty Ltd companies to reinvest their earnings into growth and innovation.

In summary, the advantages offered by Pty Ltd companies, including liability protection, tax benefits, and flexibility in operations, are integral components of "what is pty ltd means." These advantages make Pty Ltd companies a popular choice for businesses seeking to operate with reduced risk, optimize tax efficiency, and enjoy flexibility in their operations.

In summary, our exploration of "what is pty ltd means" has unveiled the distinctive characteristics and advantages of Pty Ltd companies in Australia. These companies offer liability protection to their shareholders, safeguarding personal assets from business liabilities. Additionally, they benefit from tax concessions and flexibility in operations, making them a popular choice for businesses seeking reduced risk, tax efficiency, and operational autonomy.

Understanding "what is pty ltd means" is not just about comprehending the acronym but also recognizing the legal and financial implications of operating as a Pty Ltd company. We have highlighted the significance of separate legal entity status, limited liability, and compliance with regulatory requirements. These factors contribute to the overall understanding of how Pty Ltd companies function and the benefits they offer.

Unveiling The Roots Of Success: Kaivalya Vohra's Family Legacy

Is Gwen Stefani Pregnant? The Truth Behind The Rumors

Alycia Debnam-Carey Ties The Knot: Inside Her Intimate Wedding

ncG1vNJzZmirpaWys8DEmqRvZpGiwHR6w6KeoqyRobykscCnqqmZk5rAb6%2FOpmawoJGpeqq%2FjKmrsmWcqbFuucSapaxmmKm6rQ%3D%3D